Back in December, Verizon partnered with Amazon Web Services to announce its own 5G partnership. Now, AT&T and Google Cloud are on their way to becoming a top competitor in the race to 5G and edge technologies. What does it mean for businesses in the midst of digital transformation? And what does it mean for the global tech race overall? The following are a few key thoughts.

The Cloud is Changing Again

According to Gartner, 75 percent of data generated in the future will be processed outside of “traditional cloud” technology by 2025. For those who have just spent lots of energy—and budget—converting to a cloud-based infrastructure, the thought of adding another layer to your cloud structure is overwhelming. After all, we as technologists have literally spent years encouraging businesses to move to the cloud for cost, efficiency, and agility issues. Honestly, even for cloud-native enterprises, the idea of incorporating a new method of operation for certain sets of data could seem frustrating. The thing is, the only constant in digital transformation is change. And the move to the edge, especially for certain sets of data, such as those from IoT sensors or smart cars, whose data must be managed safely and in real-time, is hugely beneficial.

The Race to Edge Computing: Stay Agile by Being Open

The announcement for AT&T and Google didn’t offer too many specifics. One thing that was most obviously missing was any type of guarantee that two would be working in a committed relationship. Indeed, it’s possible that AT&T—or Google, for that matter—could continue to create separate strategic relationships with a range of providers to determine who and what service works best in different situations. That’s good news for companies who want to stay nimble and avoid tight contracts with certain vendors in order to access the technology they are providing.

It’s Not for Everyone

Yes, it’s a new technology many companies will need to invest in. But not everyone will need to employ edge technology right away. The ones who will benefit will already be chomping at the bit to get it going. I’m talking about companies that are managing IoT resources, AIoT, real-time analytics. Companies that need to transmit data quickly to provide better experiences or make faster decisions should be looking at edge computing options, but again it’s not for everyone — at least not right now. Sure, as noted from Gartner above, much data will likely move away from the traditional cloud in the future, but the future — it isn’t here yet. You still have a few years for AT&T, Verizon, and all of the other tech companies to work out the kinks, find a fair price-point, and create an aaS product that could work for you.

Competition Will Help All of Us

It’s likely just a matter of time before other Communication Service Providers and cloud providers partner up to offer better edge computing solutions especially as 5G technology becomes more standard across the industry.

As with any new partnership announcement, the news isn’t so much about the business deal as it is about the potential of what could come of it. And right now, the AT&T and Google deal signifies that the world is ready for a bigger push into edge computing.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

AMD Reports Solid Q1 But Cautions On Its Outlook

Emotional Recognition Tech — Is It Dangerous To The Recruitment Process?

Netcracker Showcases AWS Relation To Validate Cloud Benefits For CSP Clients

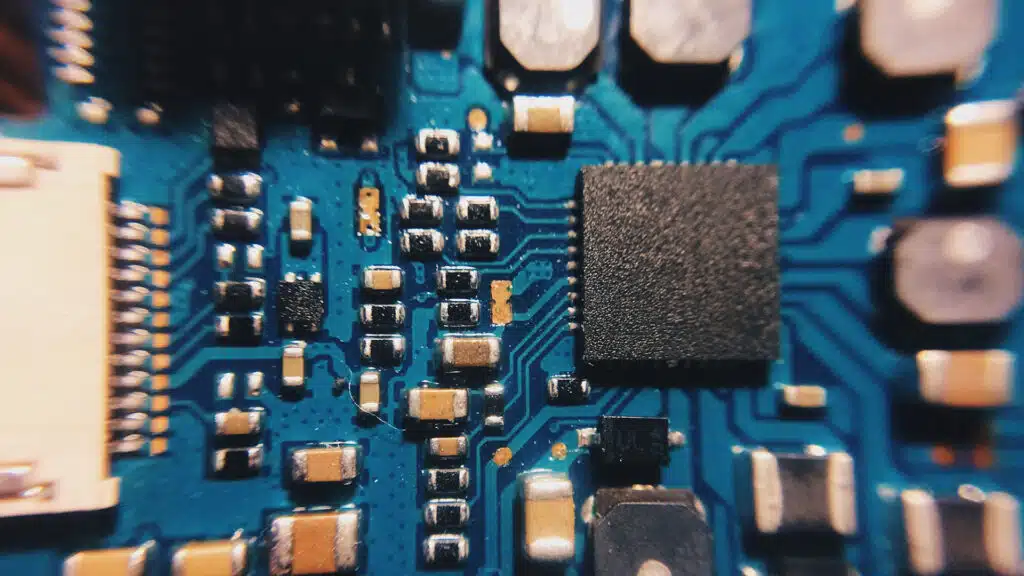

Image Credit: ITP.net

Author Information

Daniel is the CEO of The Futurum Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise.

From the leading edge of AI to global technology policy, Daniel makes the connections between business, people and tech that are required for companies to benefit most from their technology investments. Daniel is a top 5 globally ranked industry analyst and his ideas are regularly cited or shared in television appearances by CNBC, Bloomberg, Wall Street Journal and hundreds of other sites around the world.

A 7x Best-Selling Author including his most recent book “Human/Machine.” Daniel is also a Forbes and MarketWatch (Dow Jones) contributor.

An MBA and Former Graduate Adjunct Faculty, Daniel is an Austin Texas transplant after 40 years in Chicago. His speaking takes him around the world each year as he shares his vision of the role technology will play in our future.