The News: Yesterday, members of IBM’s executive team briefed investors and analysts on the continued evolution of their business direction and goals. It’s clear that IBM’s strategy and the changes the company is making around hybrid cloud and AI will set the company up for growth. Listen to the full investor briefing here.

IBM Investor Briefing 2021: The Growth is Coming

Analyst Take: IBM’s investor briefing yesterday was focused not on earnings or quarterly results, but the future and more importantly how that future will deliver growth for the company— IBM simply must return to posting healthy growth numbers given the market spaces they plan to operate in of Cloud and AI. Chairman and CEO Arvind Krishna kicked off the briefing by reflecting on the strategy that has resonated with clients — hybrid cloud and AI. Clients everywhere are using these two technologies to speed up the transformations of their businesses and meet business objectives. IBM is no different. These are the pieces of the conversation that caught my attention:

- Portfolio Optimization. IBM has made a few moves in the last couple of years that are focused on optimizing their offerings and portfolio to meet client needs. These include the decision to spinoff their managed infrastructure services unit, Kyndryl and the acquisition of Red Hat, and other targeted acquisitions this year. While infrastructure will remain an important part of their portfolio, it’s clear that the focus will be a platform-centric software model.

- Platform, Platform, Platform. The platform-centric model was a key theme throughout the conversation. The IBM software portfolio has been optimized to run on Red Hat OpenShift and deliver a full cloud native, micro-services driven experience powered by Kubernetes. This optimized model is designed to drive growth because the overall hybrid cloud space is exploding and with OpenShift IBM has acquired market leading technology. This is promising to see for investors.

- Investing in Consulting. Krishna also announced IBM will be adding more resources and capabilities for its consulting teams. Whether its helping clients work though AI optimizations or deploy hybrid cloud strategies, consulting will become a bigger part of their business offerings. IBM Services will undergo a rebrand to become IBM Consulting and will make up about a third of the business.

- Hybrid Cloud is Where the Money Is. IBM acknowledged that many clients use public cloud but are also required to use private cloud and on-premise infrastructure to meet regulations. This hybrid cloud TAM is huge and IBM is well positioned. With the added capabilities from the Red Hat acquisition, IBM’s clients can develop applications and deploy them to any location with the same level of security across all clouds and data centers. Over 3,200 IBM clients are utilizing this strategy, which is four times the amount that were using it prior to the Red Hat acquisition. Hybrid cloud is where the growth opportunity and money is for the company.

- Focusing on AI and Automation. Everyone knows that AI and automation offer a competitive advantage to companies when it is deployed correctly. IBM is ready to meet that challenge. Krishna announced that they will begin integrating AI into all business processes from hiring and talent management, to customer service.

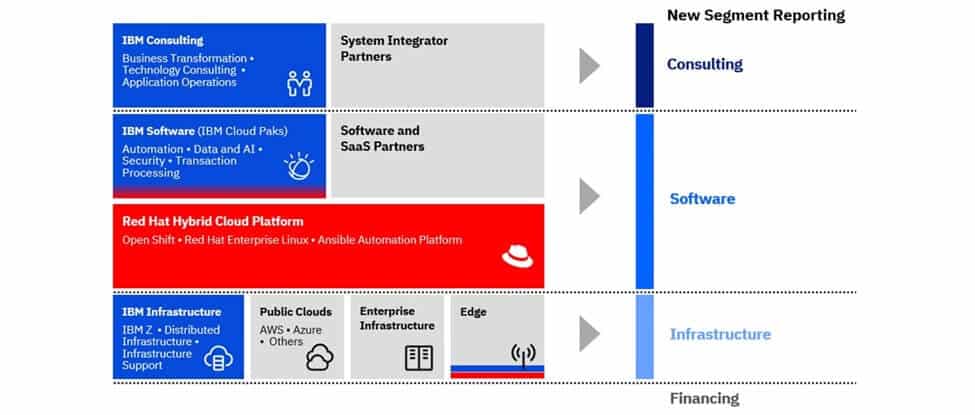

Updated Reporting Structure

IBM also revealed that post Kyndryl spin-off the company will be updating how it reports revenue to provide greater visibility and transparency. I believe this will be highly beneficial for investors and analysts that want to track the company’s success more clearly against its biggest bets.

The consulting segment remains straight forward and will be what was formerly reflected as GBS.

The infrastructure segment contains what was largely seen as systems and this subset of the business has been a profit center for the company despite the cyclical nature of this revenue bucket. This segment will also temporarily hold GTS, as I understand it, but this will exit when Kyndryl spin-off is complete. Finally, the public cloud business will fall into this segment.

The cloud has become more nebulous as it is now comprised of infrastructure, platform, software, and a variety of services. IBM is taking a new approach to have its hybrid cloud and current software offerings roll up into a broader “Software” segment. The reporting of the pieces will continue to be sought by outsiders that want to better understand the Red Hat and Hybrid Cloud growth, but like I said, as cloud becomes a bigger overarching set of deliverables, this segmentation probably does more to clearly articulate how the company is performing.

I anticipate that IBM will continue to report a “Big C” cloud number for the foreseeable future that will incorporate different pieces, so the markets can better understand the company’s overall cloud growth. I like seeing how the hybrid/software is growing and then the overall cloud as these reflect some of IBM’s biggest bets.

Clarity in Strategy Driving Growth

The main takeaway I have from listening to the briefing is that the new IBM post-Kyndryl split will be a leaner and more focused organization. The Kyndryl business will result in 96,000 people leaving IBM and ensure that clients teams are laser-focused on products and consulting services rather than long-term strategic outsourcing engagements. The company also announced that it will simplify how it plans to report results and provide much needed clarity into the operations of the business. Ideally this leaner, more focused IBM can drive high single-digit and even low double-digit revenue growth. The core focus areas of services, infrastructure, cloud, and AI are aligned with the appropriate secular trends for faster growth than the company has recently been able to achieve.

Overall IBM is positioned to help full-stack customers take their big transformation journeys to a model fueled by AI and delivered cloud natively. IBM is building an ecosystem and framework of industry partnerships based largely around open-source offerings that are agile and ready to meet the needs of their customers. While all of this is good news for IBM clients, it should also be music to the ears of their investors.

The agility this strategy offers will deliver a more robust financial model with a reliable cash flow for reinvestments and more acquisitions that will also help support the strategy. There are other opportunities for investment and growth streams with their Research and Quantum arms that were not covered yesterday. I am bullish on the long-term thesis for Quantum, and believe IBM is well positioned in this space to reap significant monetization returns as Quantum matures, and this will be something to watch for in the future. It’s a new day at IBM and they are ready to kick start growth for their investors, their clients, and themselves.

Disclosure: Futurum Research is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Other insights from Futurum Research:

The Show Must Go On: IAA Mobility – The Six Five Webcast

DISH Goes with IBM AI-Powered Assets to Advance Cloud-Native 5G Network Build

Image Credit: Business Standard

Author Information

Daniel is the CEO of The Futurum Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise.

From the leading edge of AI to global technology policy, Daniel makes the connections between business, people and tech that are required for companies to benefit most from their technology investments. Daniel is a top 5 globally ranked industry analyst and his ideas are regularly cited or shared in television appearances by CNBC, Bloomberg, Wall Street Journal and hundreds of other sites around the world.

A 7x Best-Selling Author including his most recent book “Human/Machine.” Daniel is also a Forbes and MarketWatch (Dow Jones) contributor.

An MBA and Former Graduate Adjunct Faculty, Daniel is an Austin Texas transplant after 40 years in Chicago. His speaking takes him around the world each year as he shares his vision of the role technology will play in our future.