Analyst(s): Brendan Burke, Nick Patience

Publication Date: January 28, 2026

IonQ, a quantum systems company, is acquiring SkyWater Technology, a quantum-native semiconductor foundry service provider, to vertically integrate quantum chip design, fabrication, packaging, and deployment inside the U.S. The move reframes quantum progress as a manufacturing problem and raises the bar for competitors still dependent on third-party foundries.

What is Covered in this Article:

- IonQ’s $1.8B acquisition of SkyWater and what it signals for quantum manufacturability

- Why fault-tolerant quantum timelines increasingly hinge on semiconductor scaling, not lab breakthroughs

- The strategic importance of a trusted U.S. quantum supply chain for government and defense use cases

- How vertical integration can reset cost, yield, and iteration speed assumptions in quantum computing

- Why this deal pressures the rest of the quantum market to rethink its foundry strategy

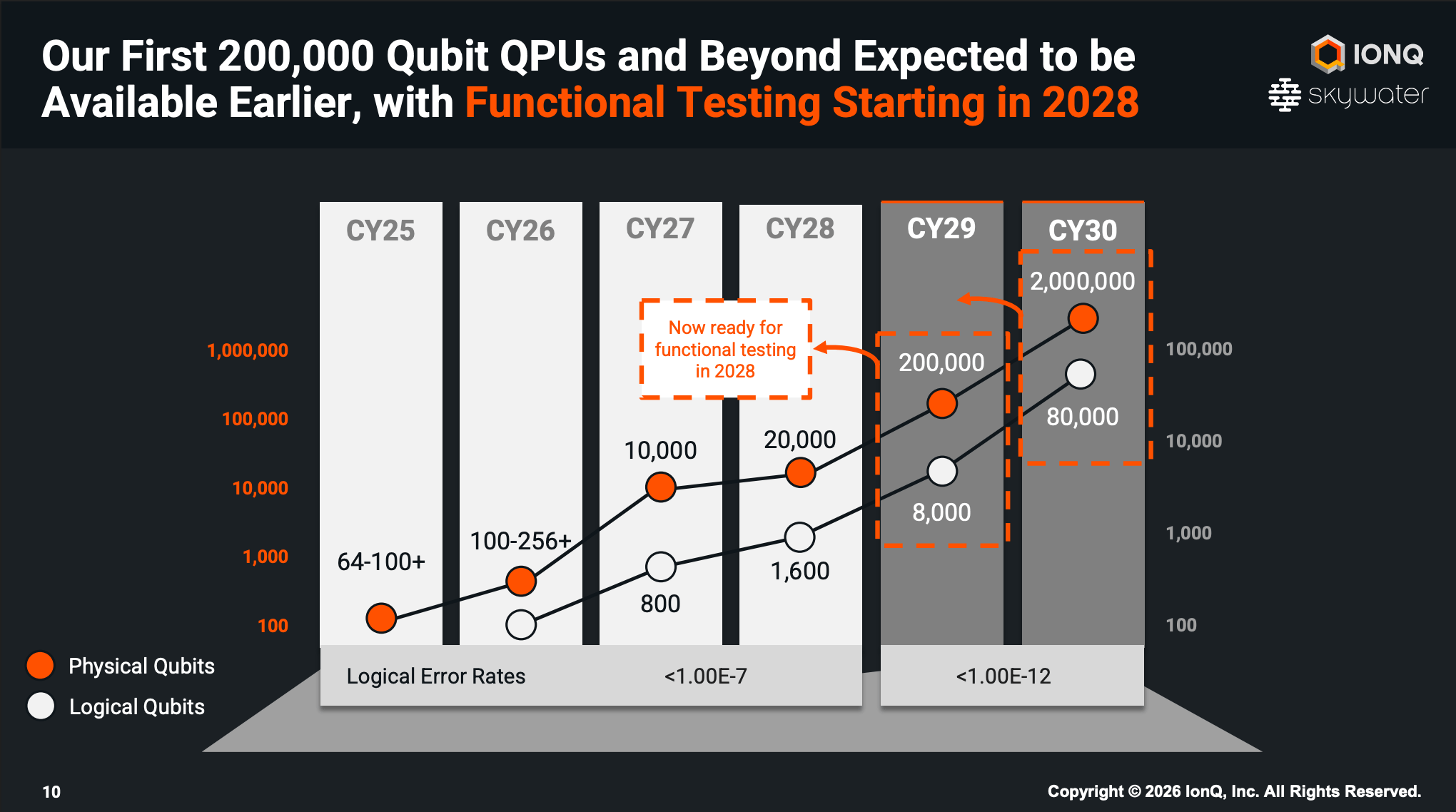

The News: Full-stack quantum computing leader IonQ announced it will acquire SkyWater Technology in a $35.00 per share cash-and-stock transaction valuing SkyWater at approximately $1.8 billion. The move gives IonQ direct access to 200mm wafer fabrication, advanced packaging, and secure U.S.-based production. IonQ says the deal accelerates functional testing of a 200,000 physical qubit quantum processing unit (QPUs) to 2028 and pulls forward a 2,000,000-qubit system by up to a year.

IonQ Buys a Foundry: Is Vertical Integration the Path to Fault-Tolerant Quantum?

Analyst Take: IonQ’s SkyWater acquisition signals the maturation of fault-tolerant quantum computing. Manufacturing capability now presents a gating issue for qubit physics. The companies racing toward fault tolerance will need consistent process modules, repeatable device unit cells, stable packaging, and fast feedback loops to gain a commercially sustainable quantum advantage.

By internalizing a U.S. foundry with advanced packaging, IonQ reduces iteration time and improves its security posture to meet the demands of government and defense buyers. Most competitors still rely on shared research fabs or merchant foundries with longer cycles and less control. IonQ’s move stands out because it directly internalizes manufacturing as a core capability rather than treating it as an external dependency.

IonQ is signaling that quantum computing must transition from laboratory development to industrial production. By integrating design, fabrication, packaging, and long-term system upgrades, the company is aligning quantum system development with established semiconductor operating models. This approach contrasts with earlier assumptions that quantum platforms would remain research-centric and loosely coupled to manufacturing infrastructure.

Why Vertical Integration Matters More Than Qubit Count

IonQ’s roadmap aligns with manufacturing capabilities that SkyWater already provides to quantum programs. SkyWater’s experience with standardized process modules enables repeatable quantum device unit cells that can be replicated at a higher density. Its ability to support multiplexed control structures addresses I/O and wiring constraints that emerge as qubit counts rise. Die-level process control and yield learning improve usable device density, while SkyWater’s advanced packaging capabilities support multi-die quantum systems as architectures scale. Together, this places IonQ’s roadmap on a manufacturing foundation built around controlled semiconductor processes rather than laboratory-scale experimentation.

The target of 200,000 physical qubits, translating into approximately 8,000 logical qubits by 2028, depends on predictable yields, stable interconnect performance, controlled thermal behavior, and consistent packaging outcomes. These are manufacturing variables. Bringing SkyWater in-house reduces iteration time and allows IonQ to co-optimize ion traps, control ASICs, MEMS, photonics, RF systems, and timing as a unified platform.

Strategic Implications for Government and Security Markets

The acquisition also positions IonQ within U S government procurement frameworks that prioritize trusted domestic supply chains. End-to-end control of quantum design, fabrication, and packaging aligns with defense and intelligence requirements for secure systems. IonQ is positioning itself as a long-term quantum infrastructure provider for national and allied government use cases.

Early deployments of fault-tolerant quantum systems are expected in government and defense environments, where security, provenance, and system assurance are mandatory. IonQ’s strategy reflects that demand profile.

Market Consequences

IonQ just raised the bar for what a credible fault-tolerant roadmap looks like. Vendors that remain dependent on external, general-purpose foundries will face longer feedback cycles and less opportunity for cross-domain optimization. Expect more aggressive foundry partnerships, joint ventures, or acquisitions across the quantum landscape as rivals try to close the manufacturing gap.

The central competitive factor in quantum computing is shifting toward the ability to build systems with rapid feedback loops. IonQ currently presents the most complete manufacturing-backed strategy aligned with that requirement.

What to Watch:

- Measurable changes in wafer iteration cycles and yields once IonQ and SkyWater operate as a single manufacturing organization

- Whether SkyWater retains its existing aerospace, defense, and commercial customers while operating under IonQ ownership

- New U.S. government and defense contracts that depend on domestic quantum manufacturing capabilities

- Progress toward the 2028 functional testing milestones for IonQ’s large-scale quantum processing units

- Foundry partnerships, acquisitions, or deeper manufacturing control by competing quantum vendors in response

- Cost per physical qubit as IonQ scales production

See the complete press release on the SkyWater Technology acquisition on the IonQ website.

Disclosure: Futurum is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum as a whole.

Other insights from Futurum:

IonQ Q3 FY 2025 Earnings: Revenue Beat, AQ64 and 99.99% Fidelity

Secure Data Infrastructure in a Post-Quantum Cryptographic World

Quantum in Context: Early-Stage Startups Are Still Finding Investors