Analyst(s): Ray Wang

Publication Date: July 17, 2025

ASML delivered Q2 2025 net sales of €7.7 billion and a 53.7% gross margin, both exceeding guidance, with installed base management, the ramp of advanced EUV systems, and strong China demand supporting robust profit and a 15% full-year growth outlook although macro and geopolitical uncertainties provide limited 2026 visibility.

What is Covered in this Article:

- ASML’s Q2 FY 2025 financial results

- ASML EUV and DUV booking in Q2 FY 2025

- Company’s regional mix performance

- Logic and memory contribution to ASML as well as the technology outlook

- Guidance and management’s outlook for 2H 2025 and 2026

The News: ASML reported Q2 2025 total net sales of €7.7 billion, reaching the upper end of guidance, with a gross margin of 53.7% that exceeded expectations. Net income for the quarter was €2.3 billion, representing 29.8% of total net sales. The company’s installed base management (IBM) sales reached €2.1 billion, while net system sales were €5.6 billion, with EUV accounting for €2.7 billion and non-EUV for €2.9 billion. The company recorded Q2 net bookings of €5.5 billion, 84% from logic customers and 16% from memory. The order backlog stood at approximately €33 billion at quarter end. China’s revenue share rose to over 25%, reflecting continued technology investments and capacity buildouts despite regulatory headwinds.

The company expects Q3 2025 net sales between €7.4 billion and €7.9 billion, with a gross margin between 50% and 52%. For 2025, guidance stands at approximately 15% total net sales growth and a gross margin of around 52%.

CEO Christophe Fouquet stated, “Our second-quarter total net sales came in at €7.7 billion, at the top end of our guidance. The gross margin was 53.7%, above guidance, primarily driven by higher upgrade business and one-offs resulting in lower costs.

ASML Q2 FY 2025 Earnings Reflect Strong Demand, but Outlook Clouded by Future Uncertainty

Analyst Take: Amid a backdrop of mixed global demand and ongoing macroeconomic risks, ASML delivered a solid Q2 performance, outperforming both top- and bottom-line guidance with revenue of €7.7 billion and gross margin of 53.7%. The upside was driven by strong momentum in its service and upgrade business, continued ramp-up of advanced EUV platforms, and resilient demand from China.

Yet, management’s cautious approach for outlook in 2026, citing macroeconomic and geopolitical uncertainty did raise our attention we will address later in this analysis.

“Looking at 2026, we see that our AI customers’ fundamentals remain strong. At the same time, we continue to see increasing uncertainty driven by macro-economic and geopolitical developments. Therefore, while we still prepare for growth in 2026, we cannot confirm it at this stage,” wrote ASML Q2 2025 press release of earnings result.

Despite the cautious stance toward 2026, the management did show great confidence on reaching its target for FY2025 and FY2030, which some media and analysts have overlooked.

Robust Installed Base and Service Momentum

To start, the installed base management (IBM) once again outperformed, with €2.1 billion in Q2 sales and strong growth in EUV service contributions. This is driven by the successful completion of productivity upgrades across the installed base, particularly upgrading NXT3800E EUV systems to full 220 wafers/hour specifications, which helped drive both revenue and margin upside. Management expects this momentum to continue, guiding IBM revenue to grow more than 20% YoY, with service capturing a larger share as the fleet of advanced tools expands.

EUV Technology Acceleration, But 2026 Outlook Unclear

Regarding the firm’s EUV system performance, ASML secured total net bookings of €5.5 billion, which included €2.3 billion in EUV orders. The company continued to ramp up production and shipment of its EUV tools, especially the NXE3800E, and the shipment of the first EXE5200B system. Management stated that the EUV revenue is expected to grow 30% in 2025 versus 2024, driven by rising logic and DRAM demand for advanced nodes supporting AI workloads.

The strong momentum for Low-NA EUV is likely driven by its leading customer—TSMC’s acceleration in 3nm and 2nm orders and production, which leads to more demand for low-NA EUV. The “very high ASP” of the EUV system is part of the reason driving up the company’s revenue and gross margins for this quarter.

CFO Roger Dassen noted, “The lion’s share of tools this year, and actually all in the second half, are 3800s, enabling customers to achieve planned capacity with fewer but more capable units.”

While we remain constructive on ASML’s EUV performance this year as well as future need for EUV for expansion production of advanced nodes, driven by sustained demand across both logic and memory—we believe several headwinds warrant caution.

First, firm’s two major foundry customers Intel and Samsung are materially scaling back their foundry capex in response to low utilization rates, a limited customer pipeline, and elevated operational costs. For example, Samsung was reportedly earlier this year to halve the foundry’s capex. This retrenchment is likely to undermine near-term system revenue for ASML. The acceleration of TSMC’s 3nm and 2nm order might boost some EUV demand, but it won’t provide a boost similar to the node transition from 7nm to 3nm, where large EUV demand appeared, and it does present some risk when ASML’s EUV sales are becoming more relying on TSMC.

Second, the long-term demand trajectory for ASML’s High-NA EUV tools remains elusive. Its key customers, including TSMC, Intel, and Samsung, have so far refrained from integrating High-NA EUV into their current technology roadmaps for leading-edge nodes such as 2nm and even the upcoming 1.4nm. Based on industry developments we are tracking, we expect meaningful acceleration in High-NA EUV adoption to begin no earlier than 1.4nm, and more likely around the 1nm node.

China and Geopolitical Factors Shift the Regional Mix

In addition to EUV, DUV secured €2.9 billion in sales in Q2, and the total revenue from China is expected to contribute over 25% of the company’s revenue in 2025, as we are seeing Chinese chipmakers continue to expand production capacity and installation. While the export control has continued to cap ASML’s ability to sell its EUV in China, China’s push in capacity build out in legacy nodes should continue to drive ASML’s sales in DUV, and we see the normalization of Chinese demand will come gradually not instantly.

Demand from China has proven stronger than management previously anticipated. The company now expects China to contribute approximately 20–25% of total annual revenue by Q4 2024, rising to “a little over 25%” in Q1 2025 — a notable upward revision that reflects sustained momentum in the region. Management also sees China’s share normalizing in line with backlog, and maintains that demand remains resilient.

“We’re saying there is healthy demand in China. The demand is not falling off a cliff. And I think we see that confirmed year after year, right, that the demand in China remains quite strong,” CFO Roger Dassen.

Moving forward, we believe it’s critical to pay close attention to how the demand will play out in 2026 given geopolitical uncertainties, increasing equipment competition in legacy nodes, as well as supply and demand dynamics between Chinese chipmakers and ASML.

DRAM and HBM Acceleration

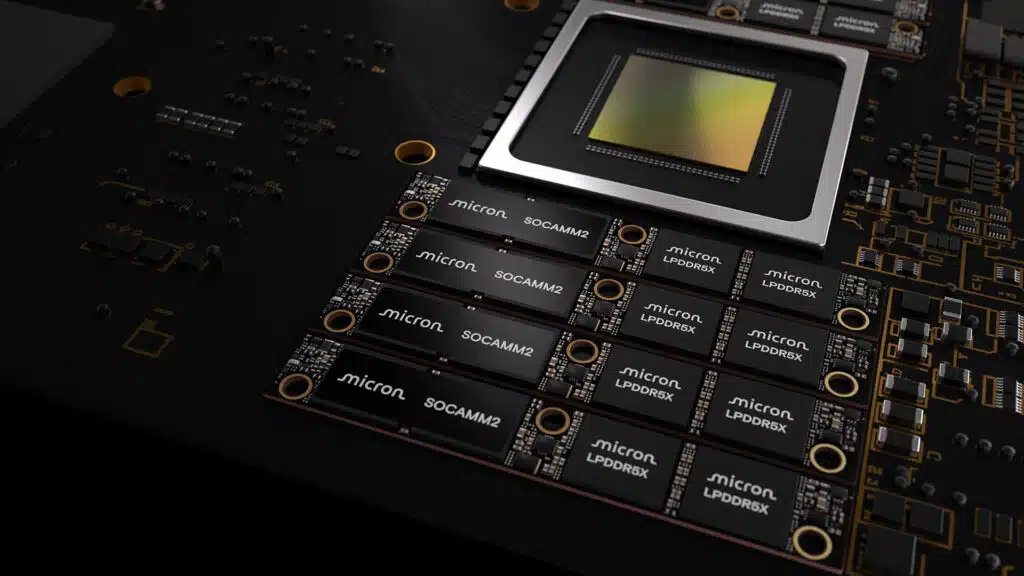

The management also stresses confidence in how the technology advancement in DRAM and HBM, as memory makers move to more advanced nodes. “In memory, we expect system revenue to remain strong in 2025 as our customers transition to their next nodes in support of the latest generation HBM and DDR5 product, ” said CEO Christophe Fouquet.

So if we look at, I would say the next three, four, five (DRAM) nodes, …we see a very positive trend with our DRAM customer, he added.

While we are positive that memory makers are indeed required to have more EUV capacity in response to expansion of advanced DRAM capacity and transition to more advanced node as we have seen in leading memory makers, we think the growth in DRAM could be limited by limited increase of EUV layer count in DRAM node as well as reuse of EUV equipments that were purchased earlier.

This likely reflects on the company’s net system sales to the memory segment, which declined by approximately 28% QoQ, falling from €2.41 billion in Q1 2025 to €1.73 billion in Q2 2025. Geographically speaking, South Korea, where two major memory makers, Samsung and SK Hynix are based, its share of the company’s net system sales dropped from 40% to 19% from Q1 to Q2.

Guidance and Final Thoughts

Looking ahead, ASML guides for Q3 2025 net sales of €7.4–7.9 billion and gross margin of 50–52%, while reaffirming its full-year guidance for approximately 15% revenue growth and a 52% margin. We remain confident that ASML’s continued technological and market leadership will serve as a key competitive advantage despite some challenges noted above, with growth underpinned by rising demand and technology transition for advanced logic and memory chips—driven in large part by AI.

The full press release is available on the ASML website.

Disclosure: Futurum is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum as a whole.

Other insights from Futurum:

The Rise of Sovereign Clouds Amidst a Fractured Global Climate

IBM Invests in Canadian Cloud Sovereignty

North Africa’s Cloud Revolution Led by Oracle

Author Information

Ray Wang is the Research Director for Semiconductors, Supply Chain, and Emerging Technology at Futurum. His coverage focuses on the global semiconductor industry and frontier technologies. He also advises clients on global compute distribution, deployment, and supply chain. In addition to his main coverage and expertise, Wang also specializes in global technology policy, supply chain dynamics, and U.S.-China relations.

He has been quoted or interviewed regularly by leading media outlets across the globe, including CNBC, CNN, MarketWatch, Nikkei Asia, South China Morning Post, Business Insider, Science, Al Jazeera, Fast Company, and TaiwanPlus.

Prior to joining Futurum, Wang worked as an independent semiconductor and technology analyst, advising technology firms and institutional investors on industry development, regulations, and geopolitics. He also held positions at leading consulting firms and think tanks in Washington, D.C., including DGA–Albright Stonebridge Group, the Center for Strategic and International Studies (CSIS), and the Carnegie Endowment for International Peace.