Analyst(s): Futurum Research

Publication Date: November 17, 2025

Applied Materials’ Q4 FY 2025 results reflect a year shaped by trade restrictions and mix shifts, with momentum centered on AI-driven nodes and advanced packaging. Management outlined product and services progress, operating model changes, and a demand outlook that weights growth to the second half of calendar 2026.

What is Covered in this Article:

- Applied Materials’ Q4 FY 2025 financial results

- AI-led WFE mix toward logic and DRAM

- New systems in epitaxy, bonding, and metrology

- Services, EPIC platform, and operating model

- Guidance and Final Thoughts

The News: Applied Materials (NASDAQ: AMAT) reported Q4 FY 2025 revenue of $6.8 billion, down 3% year over year (YoY), versus consensus of $6.7 billion. Semiconductor Systems revenue was $4.8 billion (-8% YoY), and Applied Global Services (AGS) revenue was $1.6 billion (-1% YoY). Non-GAAP operating margin was 28.6% (-0.7 points YoY). Non-GAAP net income was $1.7 billion (-10% YoY) and non-GAAP diluted EPS was $2.17 (-6% YoY).

“Based on our conversations with our customers and partners, we are preparing Applied’s operations and service organizations to be ready to support higher demand beginning in the second half of calendar 2026,” said Brice Hill, Senior Vice President and CFO.

Applied Materials Q4 FY 2025 Results Emphasize AI-Focused Mix

Analyst Take: Applied Materials’ quarter underscores an AI-led mix shift toward technology inflections where the company is most leveraged: leading-edge foundry-logic, DRAM (including high-bandwidth memory), and advanced packaging. Management highlighted improving customer visibility, extending to multi-quarter and multi-year planning for FY 2026 ramps. New products in epitaxy, hybrid bonding, and eBeam metrology align with transistor and packaging transitions expected to drive share and margin durability. Operating model updates streamline segment reporting, make AGS fully recurring, and sharpen accountability for shared costs, improving transparency for investors and customers.

AI-Led WFE Mix Aligns With AMAT Strengths

Management expects leading-edge foundry-logic, DRAM, and high-bandwidth memory to be the fastest-growing areas in FY 2026, mapping to AMAT’s core positions in transistor engineering and DRAM process steps. Customer engagement now provides more than one year, and in some cases, two years of visibility, with several advanced factory ramps targeted for the second half of calendar 2026. China-restricted revenue exposure declined to 25%–29% of quarterly revenue in late FY 2025, and the FY 2026 WFE mix is expected to tilt more toward regions and nodes where AMAT’s portfolio is strongest. Leadership emphasized co-optimization with customers across four technology nodes—spanning roughly a decade—indicating sustained process-of-record depth. This setup should benefit AMAT as AI server growth continues to pull advanced logic, HBM stacking, and advanced packaging investments. The implication is a favorable alignment between AMAT’s strengths and the next leg of AI infrastructure spending.

Product and Technology Roadmap Targets Key Inflections

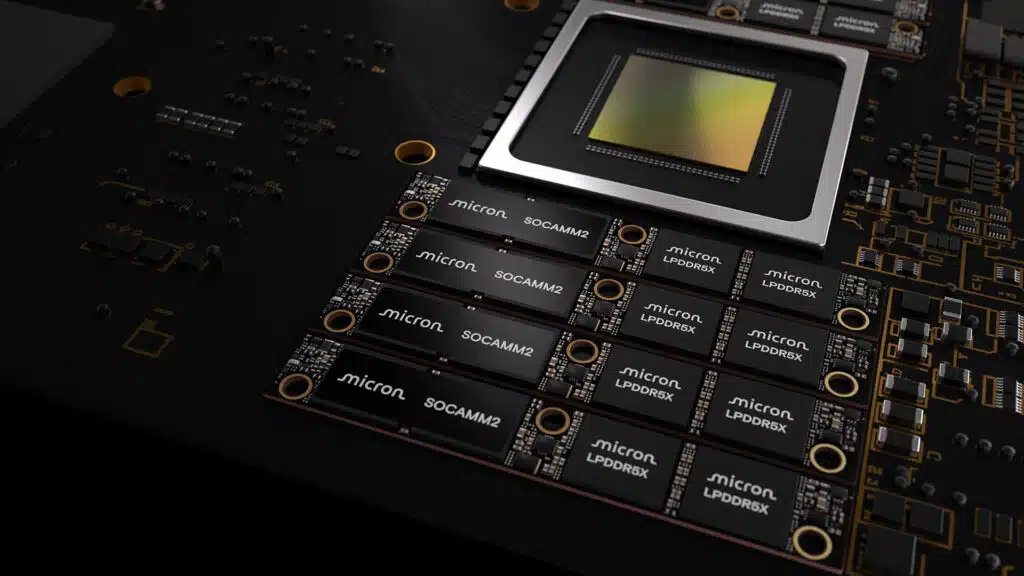

AMAT introduced Xtera epitaxy for 2-nanometer-and-beyond gate-all-around (GAA) transistors, enabling void-free source–drain structures and integrating epi, clean, and etch for a 40% improvement in uniformity and 50% lower gas usage. The Kinex integrated die-to-wafer hybrid bonder combines six steps with on-board metrology to improve accuracy, enable smaller interconnect pitches, and boost yields across heterogeneous integration and die stacking. PROVision 10 brings cold-field emission to eBeam metrology, increasing image resolution by 50% and imaging speed by 10x, targeting buried defects in 3D structures. Collectively, these systems target the most valuable inflections—GAA, backside power delivery enablement, HBM stacking, and multi-die packaging—where yield and throughput are decisive. The releases also reinforce AMAT’s “connect capabilities” approach by integrating deposition, etch, cleaning, metrology, and bonding flows. The takeaway is a focused roadmap designed to expand process-of-record positions at advanced nodes and packaging.

Services, EPIC Platform, and Operating Model Changes

AGS delivered another year of double-digit core growth in FY 2025, with more than two-thirds of AGS revenue from subscriptions, underscoring the stickiness and scale of AMAT’s installed base. Beginning Q1 FY 2026, the 200-millimeter equipment business moves from AGS to Semiconductor Systems, and AGS will become entirely recurring, improving investor visibility into services’ subscription-like growth. The company is fully allocating corporate support costs to segments in FY 2026, sharpening accountability for cost optimization and margin management. Construction of the EPIC Center remains on track to open next year, aimed at accelerating system technology co-optimization with chipmakers and designers. Workforce actions and broader adoption of AI and digital tools are intended to raise velocity and productivity ahead of H2 2026 demand ramps. Net, AMAT is aligning services, R&D collaboration, and cost structures to speed technology transfer and improve returns at scale.

Guidance and Final Thoughts

For Q1 FY 2026, AMAT guided revenue to $6.9 billion (±$0.5 billion) and non-GAAP EPS to $2.18 (±$0.20); segment outlooks include Semiconductor Systems at approximately $5.0 billion, AGS at approximately $1.5 billion, and Corporate and Other at roughly $0.3 billion. Management expects non-GAAP gross margin of approximately 48.4% and to remain near that level until higher volumes materialize in H2 FY 2026, with non-GAAP operating expenses around $1.33 billion and a modeled tax rate near 13%. With customers signaling capacity ramps in H2 FY 2026 and AMAT’s product portfolio positioned at key inflections, the setup into FY 2026 and beyond is constructive. The focus now centers on execution in leading-edge logic, DRAM/HBM, and advanced packaging programs as AI infrastructure builds out.

See the full press release on Applied Materials’ Q4 FY 2025 financial results on the company website.

Declaration of generative AI and AI-assisted technologies in the writing process: This content has been generated with the support of artificial intelligence technologies. Due to the fast pace of content creation and the continuous evolution of data and information, The Futurum Group and its analysts strive to ensure the accuracy and factual integrity of the information presented. However, the opinions and interpretations expressed in this content reflect those of the individual author/analyst. The Futurum Group makes no guarantees regarding the completeness, accuracy, or reliability of any information contained herein. Readers are encouraged to verify facts independently and consult relevant sources for further clarification.

Disclosure: Futurum is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually and data and other information that might have been provided for validation, not those of Futurum as a whole.

Other insights from Futurum:

Will Applied Materials Meet Expectations in the AI Capex Boom?

Author Information

Futurum Research

Futurum Research delivers forward-thinking insights on technology, business, and innovation. Content published under the Futurum Research byline incorporates both human and AI-generated information, always with editorial oversight and review from the expert Futurum Research team to ensure quality, accuracy, and relevance. All content, analysis, and opinion are based on sources and information deemed to be reliable at the time of publication.

The Futurum Group is not liable for any errors, omissions, biases, or inadequacies in the information contained herein or for any interpretations thereof. The reader is solely responsible for any decisions made or actions taken based on the information presented in this publication.