Analyst(s): Nick Patience, Fernando Motenegro

Publication Date: February 2, 2026

Nations across the globe, including the US, China, India, UAE, Saudi Arabia, and the EU, are investing billions to build Sovereign AI capabilities, aiming to control the full stack from chip design to foundational models. However, the extreme complexity of the AI supply chain – spanning raw materials, chip fabrication, and skilled talent – makes true 100% sovereignty a practical impossibility. Instead, nations are shifting toward strategic autonomy, focusing on controlling critical chokepoints and data layers while managing unavoidable global dependencies.

Key Points:

- True 100% national AI sovereignty is an illusion because no single nation, including the US or China, controls all seven links of the complex AI supply chain.

- The global AI landscape is defined by asymmetric strengths, with the US dominating chip design and research, the EU controlling chip-making equipment (ASML), and China building a parallel, efficiency-focused ecosystem.

- Strategic autonomy is the new pragmatic goal, as nations and enterprises prioritize data residency, model governance, and hybrid infrastructure over total self-sufficiency.

Overview:

Sovereign AI is defined as a nation’s capacity to develop, deploy, and govern AI using its own infrastructure, data, and workforce. Driven by the fear of foreign providers cutting off critical infrastructure, nations are rushing to build national AI clouds and models. Despite this push, the AI stack is too complex to own entirely; it requires rare earth minerals, lithography equipment (monopolized by the EU’s ASML), advanced chip design (led by the US), and fabrication (led by Taiwan).

The US strategy relies on alliance-based sufficiency, ensuring integrated Western supply chains while using export controls to limit rivals. China, constrained by these restrictions, has pivoted to algorithmic efficiency and open-source models such as Alibaba’s Qwen and DeepSeek to entrench its influence in non-Western markets. Meanwhile, the EU leverages its regulatory leadership (GDPR, EU AI Act) and its hardware monopoly via ASML to maintain hybrid sovereignty.

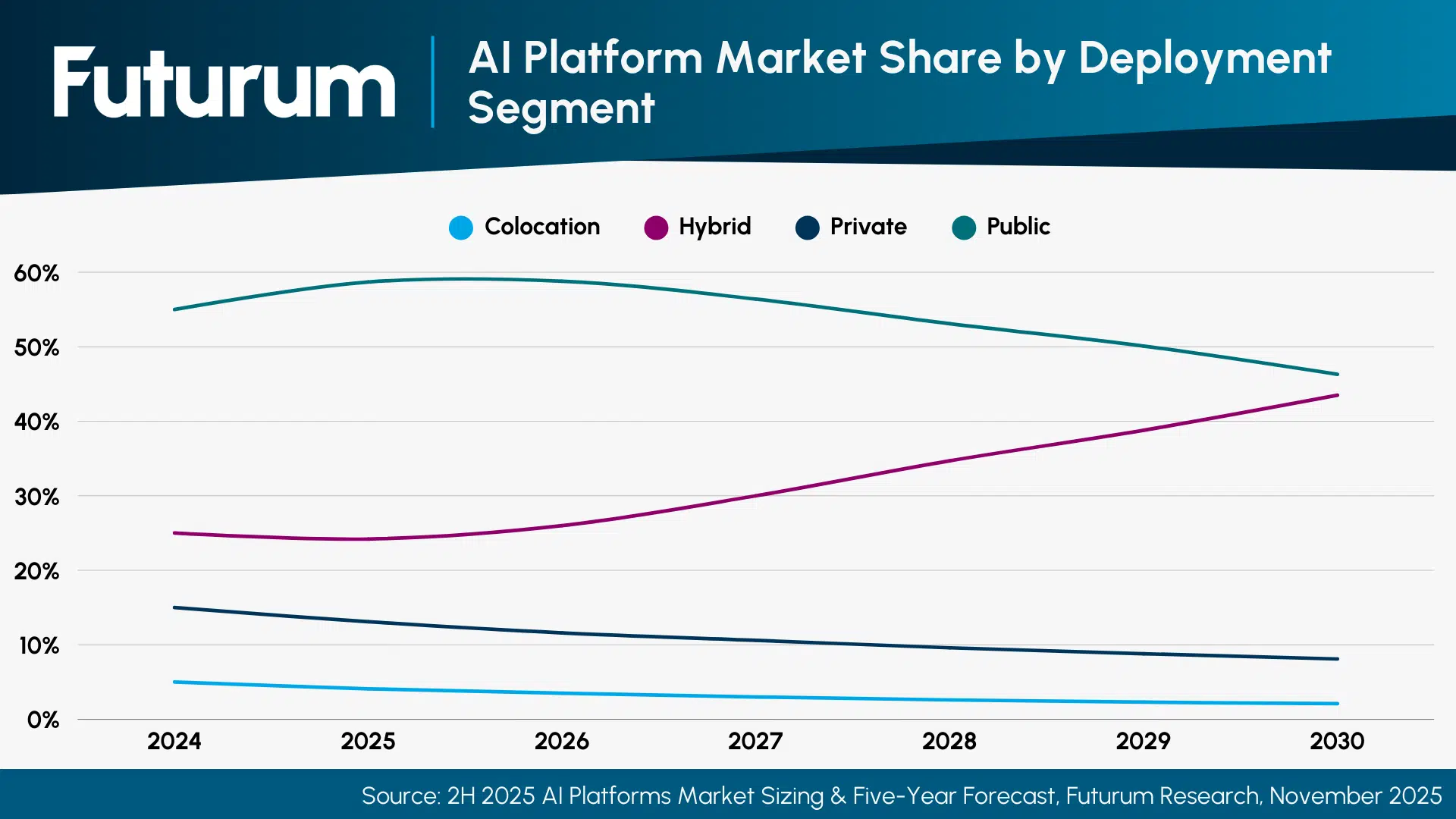

Enterprises are mirroring this national shift. There is a growing demand for sovereign-hybrid stacks that allow sensitive workloads to run in-country while still accessing global compute when needed. This is reflected in market projections where hybrid and edge deployments are expected to grow significantly as public cloud share peaks.

Figure 1: AI Platforms Market Share by Deployment Segment

The Rise of Middle Powers

The most immediate market opportunity lies with middle powers – nations such as the UAE, Saudi Arabia, India, Canada, and the UK. These nations are seeking partners to accelerate their sovereign capabilities through capital-intensive investments or by integrating AI into existing government technology stacks, as seen in India’s focus on localized language support.

Open Source Disruption

The proliferation of high-performance open-weight models (DeepSeek, Llama, Mistral, Qwen) is fundamentally reshaping the sovereign AI calculus. By utilizing “good enough” open models, nations can bypass massive foundational training costs and focus instead on the layers that matter most for their autonomy: fine-tuning, inference infrastructure, and governance.

The full report is available via subscription to Futurum Intelligence’s AI Platforms and/or Cybersecurity IQ services—click here for inquiry and access.

Futurum clients can read more about it in the Futurum Intelligence Platform, and non-clients can learn more here: AI Platforms Practice and Cybersecurity & Resilience Practice.

About the Futurum AI Platforms Practice

The Futurum AI Platforms Practice provides actionable, objective insights for market leaders and their teams so they can respond to emerging opportunities and innovate. Public access to our coverage can be seen here. Follow news and updates from the Futurum Practice on LinkedIn and X. Visit the Futurum Newsroom for more information and insights.

About the Futurum Cybersecurity & Resilience Practice

The Futurum Cybersecurity & Resilience Practice provides actionable, objective insights for market leaders and their teams so they can respond to emerging opportunities and innovate. Public access to our coverage can be seen here. Follow news and updates from the Futurum Practice on LinkedIn and X. Visit the Futurum Newsroom for more information and insights.